Supply and demand

Petroleum and gas contribution to energy supply

With the world’s energy supply chains still experiencing disruption as a result of the COVID-19 pandemic and the global energy mix rapidly changing to accommodate more renewable energy and less coal-fired generation, the demand for gas remains strong.

The International Energy Agency’s (IEA) Q1 2022 Gas Market Report for the 2021 calendar year (CY21) saw the international gas market rebound by 4.6% globally, more than double the decline seen in CY20. Global supply shortages led to tight markets and steep price increases, putting the brakes on demand growth in the second half of 2021.

Queensland’s key buying region for liquefied natural gas (LNG), Asia, saw record-high spot prices and a strong recovery in the LNG trade with an increase of 7% on the previous year and is projected to increase by a further 5% in 2022.

Locally, gas use in Australia’s eastern and south-eastern gas sectors continues to transform, predominately due to the changing mix of electricity generation.

The Australian Energy Market Operator’s (AEMO) 2022 Gas Statement of Opportunities forecasts gas to continue to play a critical role in the NEM, especially as coal-fired power generation is reduced, with gas-fired power generation predicted to support and firm variable renewable energy based power generation.

With supply from southern states expected to decline as existing resources are exhausted and less new resources being proven, traditional east coast buyers will likely be looking to Queensland and the Northern Territory as the main sources of alternative supply.

2022 East coast winter energy crisis

June 2022 saw a number of factors align resulting in extremely high energy prices for both electricity energy and gas. This was due to a combination of unusually lower temperatures across the eastern seaboard resulting in increased household demand for both electricity and gas for heating purposes, high global commodity prices and reduced coal-fired generation. This ultimately resulted in a decreased energy supply and higher wholesale energy prices.

To ensure supply came at a reasonable cost to consumers, Australian Energy Market Operator (AEMO) intervened, capping the price power generators can sell to the NEM. Due to the high costs of supplying electricity, some operators were forced to cut supply. As a result, AEMO directed all power generators to maintain supply, with the regulator supplying financial compensation.

The Australian Government is now working with state governments to ensure reliable supply at reasonable prices whilst also considering implementing a ‘capacity mechanism’, which could see some power generators being paid to stay online, rather than needing to operate in the spot market.

Regardless of the outcome, a reliable and plentiful supply of gas remains crucial to Australia’s east coast for the generation of electricity, heating and as an industrial feedstock for the foreseeable future.

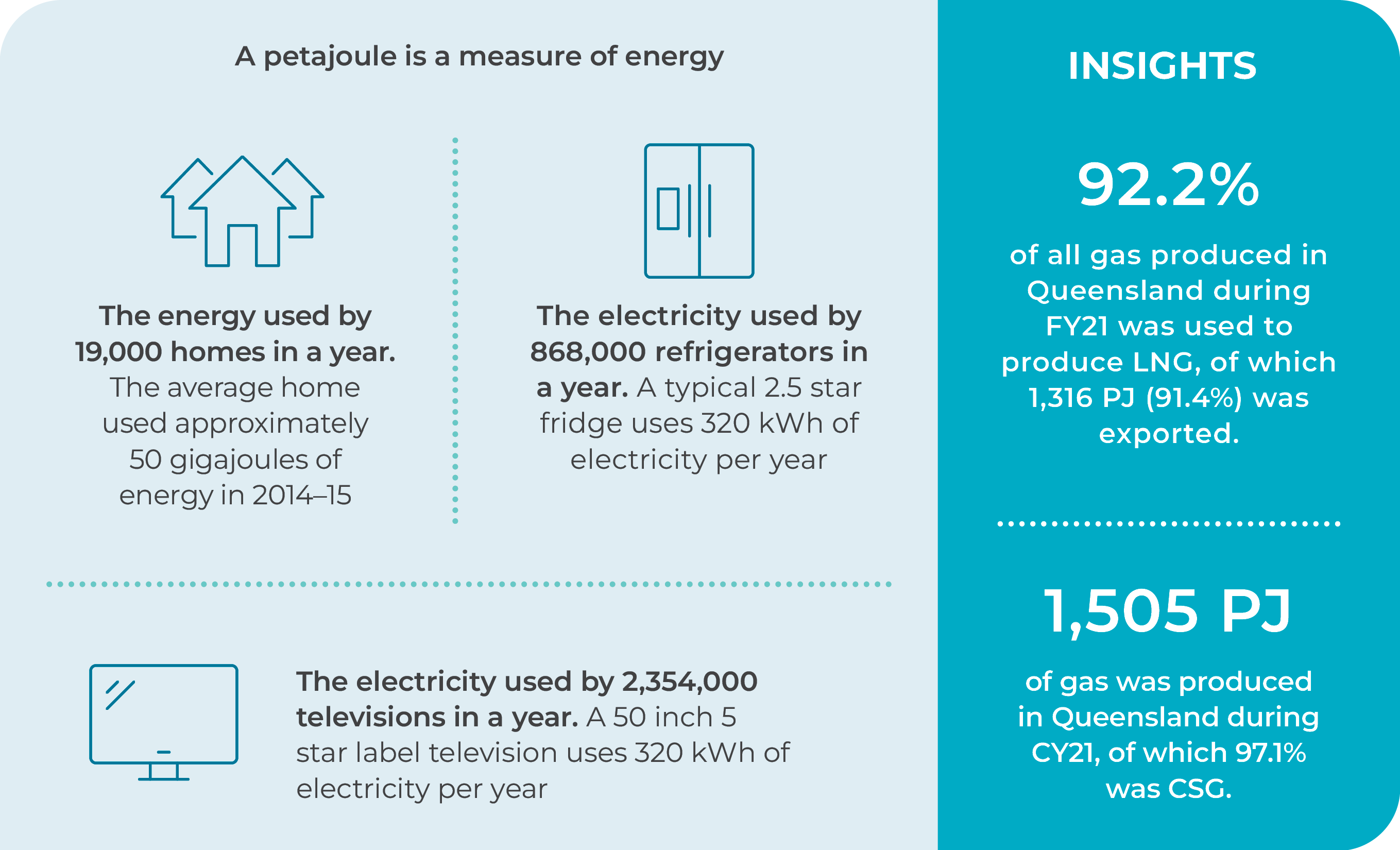

What is a petajoule?

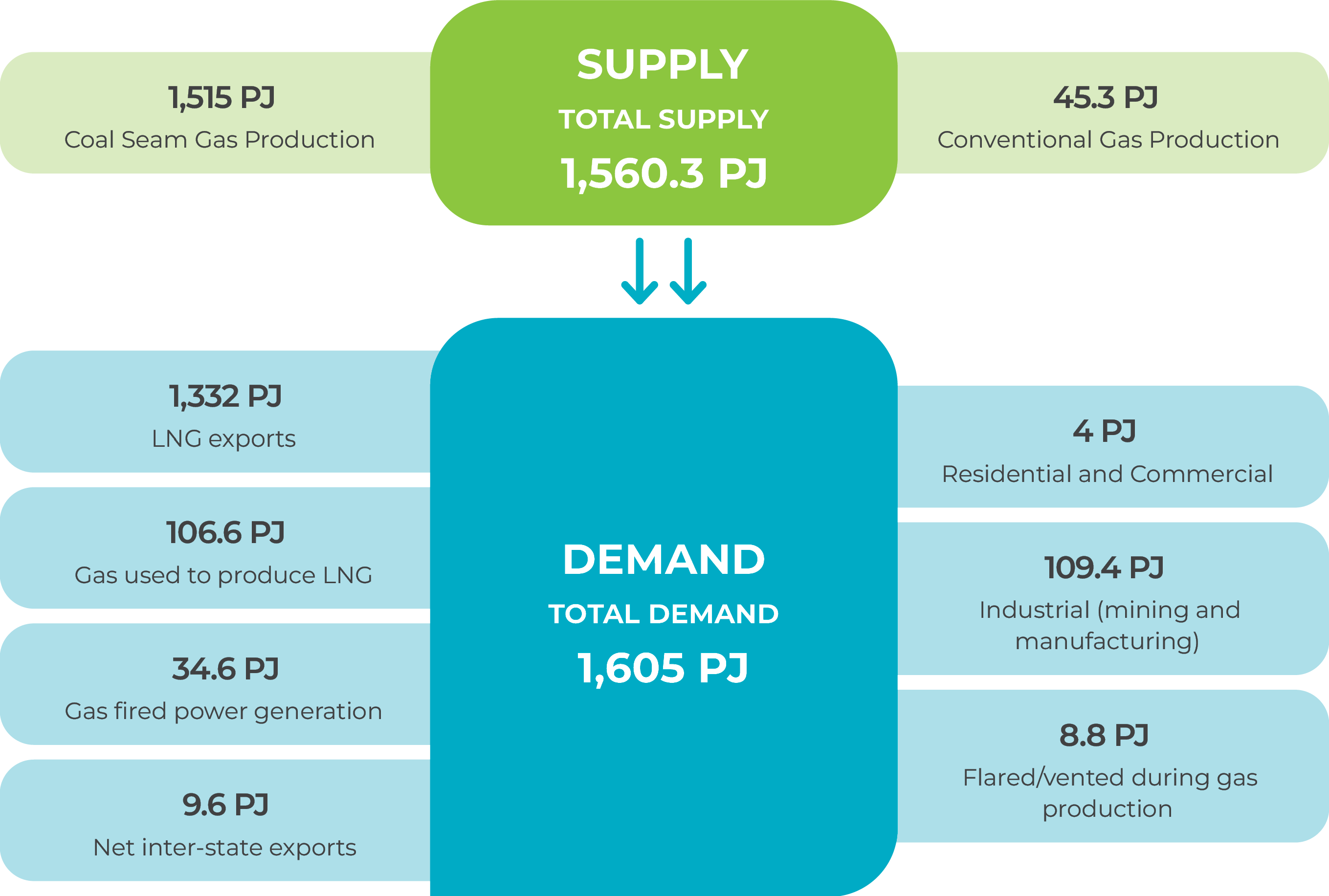

Gas supply and demand

Find out more

For additional information, insights and data, please download a PDF.

📄

Download topic PDF

Supply and demand

📑

Download full report PDF

Shared Landscapes – Industry Trends